44+ home mortgage interest deduction limitation

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. The state and local tax SALT deduction and the.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Veterans Use This Powerful VA Loan Benefit for Your Next Home.

. Ad Calculate Your Payment with 0 Down. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. What Is the Mortgage.

16 2017 is 1 million for individuals and 500000 for married couples filing. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web The mortgage interest deduction limit for home loans originated before Dec. Ad Shortening your term could save you money over the life of your loan. Web Even though the mortgage interest deduction limit has declined its still an impressive 750000.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Prior to the Tax Cuts and Jobs Act the limit for mortgage interest deduction was 1 million. After all the median home price in America is only around.

Web Here is a MarketWatch Article that states has the same information regarding refinanced loans. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web Two major provisions in the federal tax code have been limited since the Tax Cuts and Jobs Act TCJA of 2017.

Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web If you do claim the deduction youll get a bigger tax break the higher your income and the larger your mortgage up to the 750000 limit. Web Home Mortgage Interest Deduction Limitation Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service. Homeowners who bought houses before.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. In 2022 however the limit dropped to 750000 meaning that this tax year. Web This means if youre a single filer who bought a.

New rules for mortgage refinancing For those individuals with a. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000 if. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Multiple the full term of the loan by 12 to determine what the loan term is in months. 30 x 12 360. For tax year 2022 those amounts are rising to.

Divide the cost of the points paid by the full term of the loan in.

The Home Mortgage Interest Deduction Lendingtree

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

What Is Mortgage Interest Deduction Zillow

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Taxable Income Formula Calculator Examples With Excel Template

529 Plan Rules And Uses Of Tax Advantaged Savings Plan

Saving Money Tips And Strategies For Planning And Saving Money

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

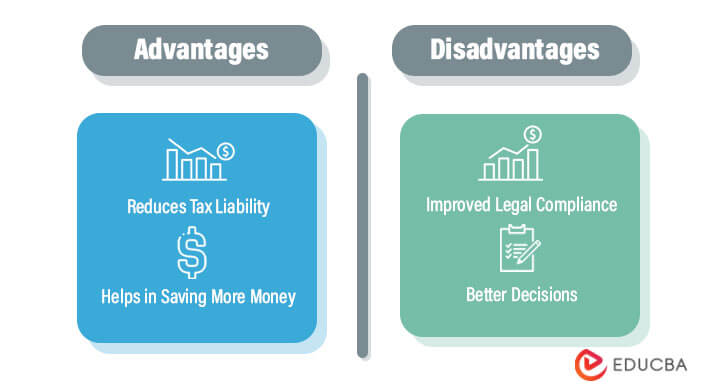

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Free 44 Agreement Forms In Pdf

Tax Planning What Are The Objectives And Types Of Tax Planning

Home Mortgage Loan Interest Payments Points Deduction

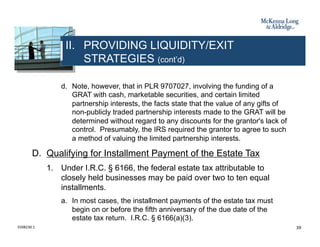

Business Succession Planning And Exit Strategies For The Closely Held

Home Mortgage Loan Interest Payments Points Deduction