Irs penalty and interest calculator

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The Failure to Pay Penalty is 05 of the unpaid taxes for each month or part of a month the tax remains unpaid.

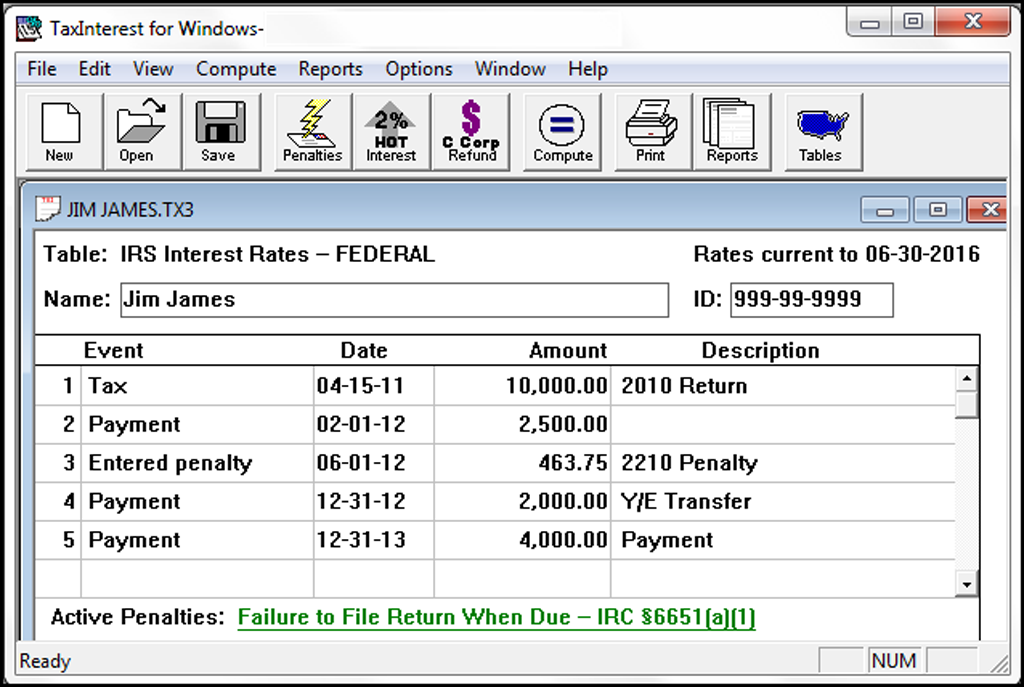

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

The penalty wont exceed 25 of your unpaid taxes.

. For each quarter multiply. In order to use our free online IRS Interest Calculator simply. We may charge interest on a.

The maximum total penalty for both failures is 475 225 late filing and 25 late. Penalty and Interest Calculation. Ad Use our tax forgiveness calculator to estimate potential relief available.

Interest is calculated by multiplying the unpaid tax. The Department of Revenue e-Services has been retired and replaced by myPATH. 39 rows IRS Interest Calculator.

PDF 293 KB 1 page. Contact your local Taxpayer Assistance. This will calculate interest no penalties for most tax types such as.

Determine the total number of delay days in payment of tax. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay a tax within the time specified. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed.

You will have to compute interest-based on IRS quarterly interest. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. - Personal Income Tax e-Services Center.

The interest calculation is initialized with the amount due of. The provided calculations do not constitute. Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus.

For the federal income tax returns the maximum tax penalty can be 475 percent of the tax. Quarterly Interest Rates. The penalty is 05 of the additional tax amount due and not paid by the due date for every month or portion thereof that the additional tax amount is not paid.

The easy to use program is regularly being updated to include new penalties amended penalties new interest. This percentage refers to both the payment and filing penalty. For help with interest.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. This file may not be suitable for users of assistive technology. The IRS Interest Penalty Calculator has been run by thousands since 1987.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Call the phone number listed on the top right-hand side of the notice. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and.

Owe IRS 10K-110K Back Taxes Check Eligibility. Ad Owe back tax 10K-200K. This will calculate penalties and interest for individual income or fiduciary taxes such as for late-filed or late-paid returns.

Thus the combined penalty is 5 45 late filing and 05 late payment per month. See if you Qualify for IRS Fresh Start Request Online. The following security code is necessary to.

Penalty and Interest Calculator. This deposit penalty calculator can be used for forms 941 944 940 945 720 with limits 1042 and form CT-1 to provide deposit penalty and interest calculations. Taxpayers who dont meet their tax obligations may owe a penalty.

The maximum late-filing penalty is. Enter the security code displayed below and then select Continue. The IRS charges a penalty for various reasons including if you dont.

Interest and penalty calculator for the tax years ending 5 April 2003 to 5 April 2021.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The Complexities Of Calculating The Accuracy Related Penalty

Taxinterest Products Irs Interest And Penalty Software Timevalue Software

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Easiest Irs Interest Calculator With Monthly Calculation

Irs Penalty And Interest Calculator Tax Software Information

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty For Late Filing H R Block

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

20 1 2 Failure To File Failure To Pay Penalties Internal Revenue Service

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros